Moore's Laws

Yes, plural. The familiar 1965 "Moore's Law" describes a doubling of chip density every two years. This was an empirical fit to experience, NOT a physical law of the universe, though the Singularity folks assume it is, disconnected from any other physical law or phenomena.

There is a second empirical Moore's Law, also known as Rock's Law, which observes that the cost of a new fabrication plant (fab) doubles every four years.

In 2015, the price of a fab was 14 billion dollars. Intel builds two or three new fabs per process generation; TSMC (their major technological competitor) a few more. In the heyday of the semiconductor industry, dozens of companies built new fabs and pushed chip density, now very few do, because a 14 billion dollar fab greatly exceeds their sales revenue.

The newest EUV processes will shrink devices perhaps another 2x. These use 13.5 nanometer wavelengths ( blue light is 400 nanometer), with an energy per photon of 92 electron volts. That corresponds to a photon "temperature" of 1.2 MILLION degrees Kelvin, focused on a very tiny device. I am amazed that these tiny little devices are not destroyed by this energy bombardment. The engineers at Intel are clever, but when the energies get too high, the energy will destroy molecular structure and crystal lattices.

There will be other imaging modalities besides photons (cold coherent helium? molecular biology?), but photons are the "currency" of Moore's law scaling. New modalities will have new constraints and empirical fits, and Moore's law will be replaced by a different empirical law.

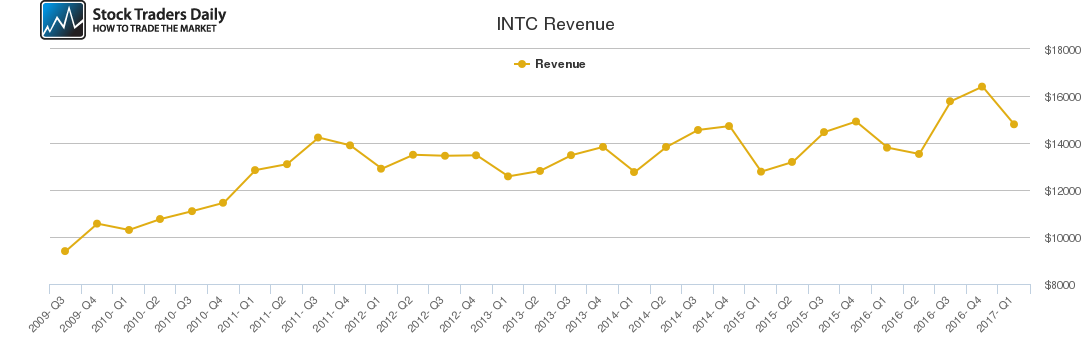

But for the sake of argument, what would a "forever" Moore's Law actually mean? Assume the entire scale-driven semiconductor industry shrinks down to a single company, Intel. Intel is owned by investors, investors expect a profit, and Intel's revenue must pay for profits, salaries, benefits (pensions for all the old Intel employees), electricity and water and ... fabs. As a rough rule of thumb, what Intel pays for fabs cannot grow faster than revenue. Here's Intel's revenue since 2009:

larger version Note: the graph runs from $8G, not zero, so the slope is exaggerated about 2x.

larger version Note: the graph runs from $8G, not zero, so the slope is exaggerated about 2x.

From 2009 to 2017, revenue grew about 1.6 times, not the 16 times cost of two new fab generations (41% increase per year) that a naive extrapolation of Moore's Laws predict. Over that time, the dollar inflation rate was about 14%, so the revenue growth was 1.4 times in constant dollars (4% per year)

Perhaps Moore's Laws might have been a good fit to calendar years before 2011; they are no longer.

So, what IS a good fit? The "kernel" of Moore's law is that a 2x increase in fab cost buys two doublings of density ... 4x! That means that in a mature market, with most revenue devoted to purchasing new fabs, density is proportional to the square of accumulated revenue.

Observationally, revenue doubled and density more than quadrupled since 2009. How will Intel pay for the newest 13.5 nanometer fabs? Layoffs.

Employees consume revenue, including their fully vested pensions. Lay off thousands of people, and there is more money for the next fab. This is a short term fix; the fewer remaining employees will produce new process miracles at a much slower rate. However you slice it, in the long term chip density can only grow if revenue does. And on a planet with a finite appetite for electronic devices, revenue cannot grow faster than demand.

1.4 times real revenue growth in 8 years is an annual real revenue growth rate of 4%, leading to a density doubling every nine years, not every two. And that is predicated on the 4% real growth continuing for another 9 or 20 or 60 years. In fact, the graph shows increasing oscillations around slow growth, and a downtick in revenue over the most recent quarter. Perhaps Wall Street blames this on incompetent management, but revenue requires sales, which requires customer demand. Intel can't give companies and individuals more money to buy their products; that requires global economic growth, and more global income to spend on the products that use Intel's chips.

I hope that Server Sky can help the bottom billions in the developing world become rich enough to purchase "Intel Inside" products, and educated enough to design the applications that make those products more valuable to the rest of us. Flattening growth is not Intel's problem, it's ours.

Singulatarians: stop waiting for miracles. Work your ass off and make some. The easiest miracle is not doubling your own wealth; it is doubling the wealth of someone with almost nothing. I hope Server Sky will enable this; that's why I am working my ass off. You can help the world's poor directly, help with Server Sky, or help some other project that will add the world's poorest to the world's most productive. Inclusion is profitable. Do something, please!